Visa facilitates Tap to Phone in transit payment systems

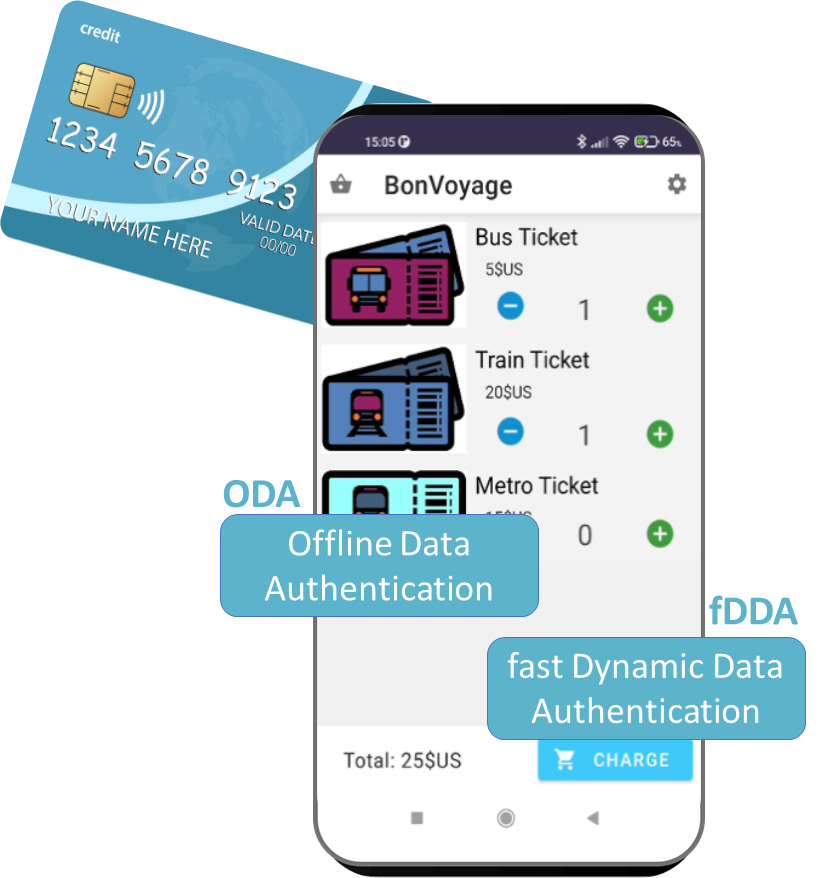

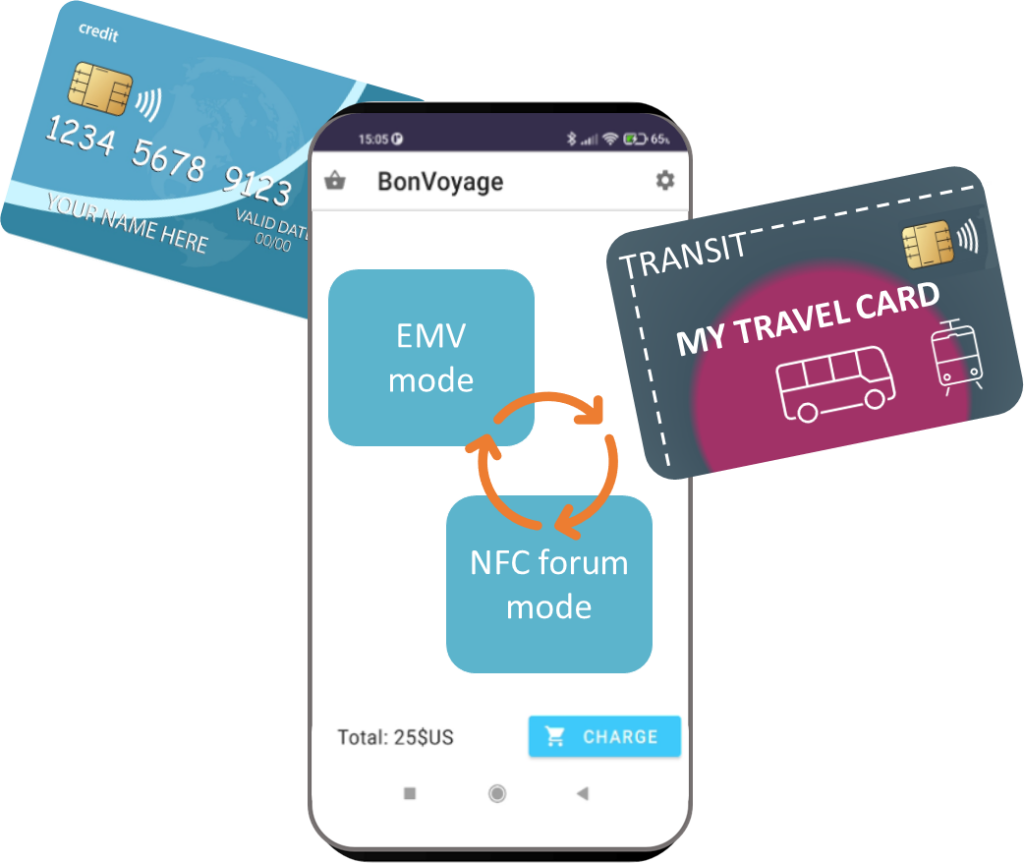

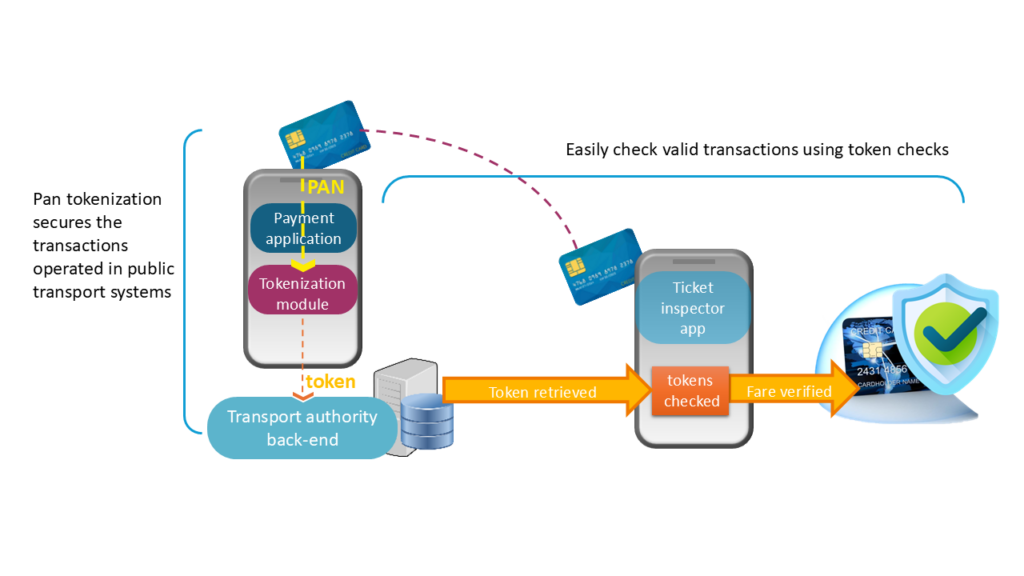

SoftPOS technology enables the acceptance of contactless payments on NFC smartphones or tablets. It offers flexibility, convenience and security that agents in transit networks need to take contactless payments on the go and perform fare inspection.

Visa has updated their tap to phone specification to reflect this new use case and simplify the deployment of SoftPOS solutions in the transit payment system.