CB is a recognized and innovative payment network

The French payment card system has a long history linked to the expansion of chip cards, and after 40 years continues to drive innovative projects and to promote interoperable banking services.

Groupement des Cartes Bancaires CB was set up in 1984 to implement a universal and interoperable card and mobile payment system, as well as a system for cash withdrawals from ATMs in France. It is the governing body of the CB card and mobile payment system. CB is the leading payment network in France, with over 65% of household purchases paid for with a CB card or mobile phone.

In 2022, there were:

- 76 million cards in circulation

- 50,000 Cash Dispensers

- 2 million CB merchant contracts

- 15 billion transactions (including 7 billion in contactless mode), representing a volume of €685 billion

- 2 billion e-commerce transactions

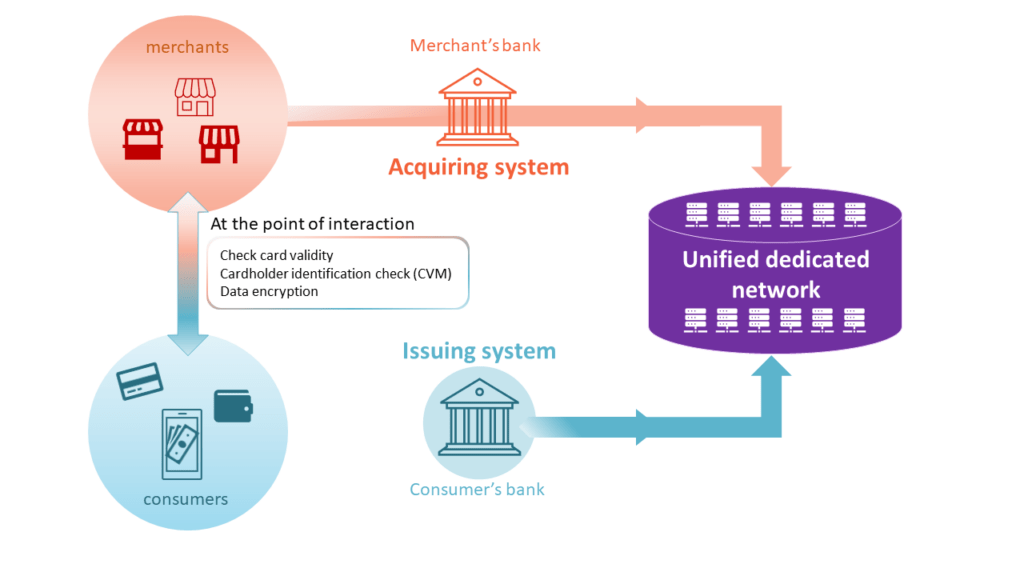

Retail transaction flow – CB system

Protection and reliability

One of the main objectives of CB is to ensure a high-end level of protection for cardholders and merchants, either for online or in-store transactions.

The network offers a high level of reliability with a performing authorization system. It defines the rules and procedures that acquirers must apply to protect their merchants in case of fraud. In addition to those rules, CB bases its transaction analysis on a performant fraud management tool, leading the scheme to maintain a very low rate of fraud.

Why payment terminal providers choose CB network and FRv6 application ?

All payment terminals deployed in the French market shall be approved by CB.

With over 65% of daily transactions operated with CB, it is crucial for payment solution providers to integrate CB application to their payment terminals to deploy in the French market. Most of the cards issued for French consumers support CB payment application and most of them are also cobranded with international card brands, for international payments.

The new FRv6 specifications provide many capabilities for seamless transactions. This standard embed a high level of protection, limiting the risk of fraud with the support of online PIN for contactless transactions. It also simplifies the principle of interoperability promoted by CB. With FRv6, one payment terminal can support contactless transactions initiated with all international card brands accepted in France.

This application simplifies the transaction flows in the payment ecosystem : one device to support all types of payment cards, a standardized protocol to process all transactions.

With FRv6, CB carries payment innovations into the French payment market and offers to merchants of all size the opportunity to onboard digital payments.

CB carries innovation in France and in Europe

SoftPOS

In addition to the expansion of the new payment application FR V6 to facilitate the acceptance of all types of cards for merchants, CB is also opening the way to more innovative ways of accepting contactless payments.

The SoftPOS technology (Tap to Phone or Tap on phone) enables merchants to transform their smartphone into contactless payment terminals, without the need to carry extra hardware for card acceptance.

SoftPOS facilitates and fluidifies the payment experience for users while ensuring the protection of sensitive data in a software-only environment. Many acquirers have started to deploy their solutions in France in 2023 with the support of CB, which is a crucial engagement for the adoption of this new technology.

CPACE

CB is one of the largest network in Europe, counting almost 25 % of the total amount of transactions in the euro zone – according statistics from the ECB (European Central Bank)

The CPACE payment application will simplify the payment experiences for hundreds of millions of European citizens, extending payment interoperability across Europe.

To know more about the benefits and payment solutions carried by CB, visit Cartes Bancaires website.

Get in touch with us : info@alcineo.com